The 10 Best Financial Advisors for Millennials in 2026

January 15, 2026

Financial planning for Millennials now comes in many forms, reflecting our generation’s unique interests and circumstances

With a new year comes new opportunities to build your wealth.

But how can you know what steps you must take to grow your wealth in 2026? To start, you may want to review my annual list of the best financial advisors for Millennials in the U.S.

I’ve learned from my own Millennial clients that January’s arrival prompts many of us to renew our financial focus. For example:

- How can we make more progress?

- Can we finally address those lingering financial questions we have?

- How should we deal with our financial uncertainty?

If I’m in your position, I would seek out financial planning for Millennials specifically. And this is who I would trust with my own family’s money.

But first, let me tell you how I would think about the financial planning search process.

What’s New in 2026: Millennials Increasingly Care for Children and Their Parents

Personal finance is always filled with some amount of complexity and uncertainty. And for many Millennials, this dynamic has only increased in recent years.

A recent New York Life survey suggests that “Millennials represent 66% of self-reported caregivers,” with those surveyed spending as much as 50 hours per week in a caregiving role. And “almost half (47%) of those surveyed say they have faced financial hardship due to caregiving expenses.”

There’s no easy solution for the financial stain that caregiving can cause. But prudent savings and investing decisions can help to balance financial flexibility and financial growth.

As a result, this is a topic that many financial advisors who work with Millennials will keep an eye on in the year ahead.

What Is a Financial Advisor for Millennials?

For many decades, financial advisors in the U.S. worked almost exclusively with wealthy retirees.

For example, let’s go back to 1989. If you were in your 30s then, you may have wanted practical, empathetic advice about all of your financial decisions. Unfortunately, you probably didn’t “qualify” for much help.

In other words, you didn’t have enough investments.

If you’re a Millennial in 2026, though, you’re in a much better situation. In fact, many of my friends in Washington, DC are surprised to hear how many options now exist within the financial planning profession.

You can find financial advisors who share your same background, interests, and stage in life. Unlike in the past, financial advisors for Millennials understand the specific financial challenges you face (deciding how to invest your money) and the questions you have (like “What should I do if I expect to receive an inheritance in the years ahead?“).

As evidence, I’ll introduce you to 10 financial advisors whom I would be happy to hire for my own family. These are the 10 individuals who I believe are the best financial advisors for Millennials in the country this year.

The Advantages of Working With a Millennial Financial Planner

Are you between roughly 28 and 44 years old? If so, searching for a peer who offers financial planning for Millennials may make intuitive sense to you. But what do you actually gain from hiring such a specialized advisor?

Most importantly, financial advisors for Millennials address questions that financial advisors historically have ignored, including:

- Renting vs. buying a house

- Pursuing financial independence or early retirement

- Seeking out merit aid as part of saving for college

- Repaying student loans

In addition, many financial advisors for Millennials have thoughtfully created business models that cater to our generation. For example, you may work with someone who:

- Charges you a flat, fixed fee rather than taking a percentage of your investments as compensation

- Exclusively holds virtual financial planning meetings so that you don’t need to travel

- Offers client-friendly technology to help you track your financial progress

- Doesn’t judge or scold you for wanting to use your money in seemingly “irrational” ways

The Disadvantages of Working With a Millennial Financial Planner

When you’re browsing financial advisor websites, you may notice that many of the largest and oldest companies look and sound the same.

By comparison, most financial advisors for Millennials clearly think differently about financial planning. And our online presence reflects these differences. We very intentionally create logos, websites, messaging, and social media profiles that feel more personal than the industry standard.

But even if that shift in style and approach appeals to you, our financial planning services won’t fit you well if you’re currently in a different stage of life. If you need a hip replacement, you wouldn’t want to work with a pediatrician, right?

Similar logic now applies to financial planning as well. Millennial financial advisors aren’t the ideal people to help a pre-retiree with Medicare or Social Security decisions. Similarly, we’re probably not the best possible fit for members of Gen Z, either.

But don’t worry if we ultimately identify a mismatch. We’re always happy to recommend another, more suitable financial advisor in our professional network that we also respect and trust.

How Can You Find the Best Financial Advisors for Millennials?

You might assume that, across the country, the various financial advisors for Millennials view themselves as competitors. The reality could not be more different. In fact, I would describe us as a like-minded community.

We each can only help 25-75 Millennial households, which clearly represents a tiny fraction of the entire Millennial population in the U.S. So our interaction actually revolves around sharing information and ideas. In doing so, we all become better at helping our Millennial clients.

As part of your financial advisor search, you likely start with or eventually turn to Google.

I’d suggest first searching for “financial advisors for Millennials” or “financial planning for Millennials.” These queries likely will deliver results that emphasize several industry-specific organizations.

Most notably, the XY Planning Network is the financial planning organization that counts the most financial advisors for Millennials as members. But you also may have success with the following three groups:

When you’re considering specific financial advisors, first review each advisor’s website. Ideally, you can watch a video they’ve made and read several blog posts they’ve written. This type of content is particularly helpful for understanding a financial advisor’s style, values, and perspective.

Their social media activity also can help you learn what type of financial discussions they’re regularly engaged in.

Then, once you’ve identified a few potential fits, I would e-mail 2-3 financial advisors to get answers to the most important questions you have about their ability to help you specifically.

Financial Advisors for Millennials: An Example (Part 1)

Even a group as narrowly focused as financial advisors for Millennials have important differences. But let’s first dig into a few more details about our similarities.

I’ve already discussed how we all specialize in Millennial financial issues. We also share a few additional characteristics that are critical to your search. No matter which advisor you ultimately work with, you must always demand the following from them:

- We’re all CERTIFIED FINANCIAL PLANNERS™. The CFP® designation is the highest standard in the financial planning profession. You shouldn’t settle for anything less.

- We don’t sell any financial products, such as insurance, to earn compensation. Instead, we’re all fee-only financial advisors.

- We all have signed a fiduciary oath. This oath commits us to acting in your best interest 100% of the time. Unfortunately, most people who work in finance have not committed to the same standard.

With all of the above said, let me officially introduce you to (in my opinion & in no particular order) the 10 best financial advisors for Millennials in the U.S. as of January 2026:

The 10 Best Financial Advisors for Millennials in the U.S.

Valerie Rivera, CFP®, FirstGen Wealth – Chicago, Ill.

“I have a strong social justice bone. I believe the system is designed to widen the wealth gap. We place the blame on the individual and not the corporations or government supporting financial exclusion. Part of my mission is to break this cycle. To guide all the Firsts and act as a catalyst to feel secure about your own financial success. To create generational wealth. I have a huge focus on providing education and meeting people where they are in life for no shame, no judgment financial planning that will transform your life.”

Autumn Knutson, CFP®, Styled Wealth – Tulsa, Ok.

“Wealth is deeply personal and self-defined. Styled Wealth provides a custom-tailored approach to financial planning, focusing on your unique definition of a wealthy life. I’ll guide you on a clear, optimized path toward realizing your financial goals and magnifying your impact.“

Leighann Miko, CFP®, Equalis Financial – Los Angeles, Ca.

“I believe financial guidance should be equally accessible to all, but this is rarely the case in the traditional world of financial planning. I’m here to change that. Like my company name suggests, I founded Equalis Financial to serve historically excluded communities like LGBTQ+ corporate creatives and other thoughtfully ambitious progressives. My “why” is to help others create the financially secure life I never thought I’d have after growing up in a financially volatile environment.“

Meg Bartelt, CFP®, Flow Financial Planning – Bellingham, Wa.

“We find motivation in the women we work with. Their willingness to show up. To tackle tough issues (at their own pace). To work towards the life they want, even when it’s not entirely clear what that is. And to find opportunities to laugh (even if ruefully) along the way. We focus on women in their early to mid career because this is when so much Is happening! Changing jobs. Changing careers. Buying a home. Getting married. Having babies. Existential crises. Most of these women have never had to deal with the scale and complexity of the finances they now have, and they have precious few people to talk to about it all.”

Samuel Deane, CFP®, Rora Wealth – Atlanta, Ga.

“Rora is an independent planning-first advisory firm with expertise in equity compensation. Our empathetic discovery process and therapy-like approach to financial planning help you understand what it’s all for and the steps needed to get there.”

AJ Ayers, CFP®, Brooklyn FI – New York, Ny.

“AJ is a Certified Financial Planner™ who specializes in helping creatives and tech professionals build wealth. In her 20s she watched so many friends succeed creatively while still struggling with their finances and realized it was time to do something about it so she started a financial education podcast and went back to school to become a financial planner. AJ launched BKFI with Shane (Mason) shortly after his guest appearance on her podcast. …As a writer and editor with a strong background in communications, AJ is passionate about delivering Brooklyn FI’s message to our clients and the community.“

Thomas Kopelman, CFP®, AllStreet Wealth – Indianapolis, Ind.

“At AllStreet, you’re not another number - you’re part of something bigger. We exist because the financial industry has neglected the younger generation for years. We’re not like the big financial firms you see on TV that serve retirees and sell insurance. We’re a small firm who sees a problem with the lack of financial advice being provided to our generation and we’re on a mission to solve it.”

Chloé Moore, CFP®, Financial Staples – Atlanta, Ga.

“As a woman of color in the financial services industry, I understand the unique challenges and opportunities that come with being the only one in the room. Approximately 23% of Certified Financial Planner™ professionals in the United States are women, and approximately 1.7% are black. The statistics are similar for underrepresented and underserved populations in tech (women, people of color, the LGBTQ community). I’ve built my firm to address the needs of these populations. In addition to helping you grow financially, I can help you gain clarity around your ideal life, build a network of professionals who can work together to help you achieve your goals, and point you to resources that can help further your career.”

Ryan Frailich, CFP®, Deliberate Finances – New Orleans, La.

“Before becoming a fee-only financial planner, I worked as a teacher and then as a school administrator overseeing HR, including recruiting and hiring teachers. Working in HR revealed a lot about the financial lives of employees, and that’s where the lightbulb went off. Too many people feel overwhelmed with their finances, always wondering if they’re making mistakes. And too many people who want help are taken advantage of or shut out by our financial institutions.“

Rianka R. Dorsainvil, CFP®, YGC Wealth – Lanham, Md.

“As a Certified Financial Planner™ with over a decade of experience, Rianka approaches financial planning with a strong emphasis on financial education and provides business owners, individuals, and families with the tools to make informed financial decisions. Rianka firmly believes individuals can make positive long-term decisions about their money if they understand their financial history, money culture, and the way those two things impact their lives.“

Keep in mind: this isn’t an exhaustive list, so you may want to continue your search elsewhere. The process can feel slow, daunting, and/or overwhelming at times, but the steps that I describe in the article eventually will lead you to the right fit!

(Required disclaimer: The above list reflects my opinion and is not a testimonial or endorsement.)

Financial Advisors for Millennials: an Example (Part 2)

How different can financial advisors for Millennials actually be? Isn’t such a unique business model already enough?

You may noticed, though, that the financial advisors I highlighted above all bring their own beliefs and life experiences into the financial planning process. As a result, they’ve chosen to serve slightly different Millennial clients. And they’ve become experts in slightly different financial topics.

To illustrate, I’ll use my company, Illumint, as an example of how and why you might want to distinguish between your potential options.

Illumint offers financial planning for Millennials in Washington, DC. Since 2017, I’ve designed Illumint to meet Millennials like you exactly where you are in life. I aim for my clients to always view me as a financial partner that will grow with them as life changes. So how does my particular approach impact the advice that my Millennial clients receive?

1. Illumint’s specific focus continually evolves to reflect your (and my!) new life experiences. I created the company to address the challenging new financial questions that my friends faced after they began to have children. Today, by contrast, the company specializes in helping Millennial women make the most of their money, especially an inheritance, bonus, or other savings. After all, money is a tool that you should feel empowered to use on life experiences that you value.

2. At Illumint, financial planning ultimately isn’t about “tactical” decisions, like choosing between a traditional IRA or a Roth IRA. “Wait, what?,” I hear you saying. Instead, I want to work with you to use your money to create the best possible life you can. So I make our work together highly personalized. I want to know about you, what you like and dislike, and what your interests are. Investment decisions are only sustainable if we align those decisions with how you want to use the money.

3. Illumint takes a thoughtful, but skeptical approach to financial technology. In other words, I’m very picky about the software or apps that I encourage my clients to use. Financial technology often turns into more of a distraction than a benefit. In some cases, an app even can encourage counterproductive actions. Many times in personal finance, simplicity beats complexity and shiny new objects.

Illumint’s intentional focus has empowered more than 125 Millennial families live less stressful, more fulfilling lives in recent years. And several media organizations have noticed, with Business Insider naming me one of the “best financial advisors for Millennials in the U.S.” and Washingtonian naming me a top financial advisor in Washington, DC.

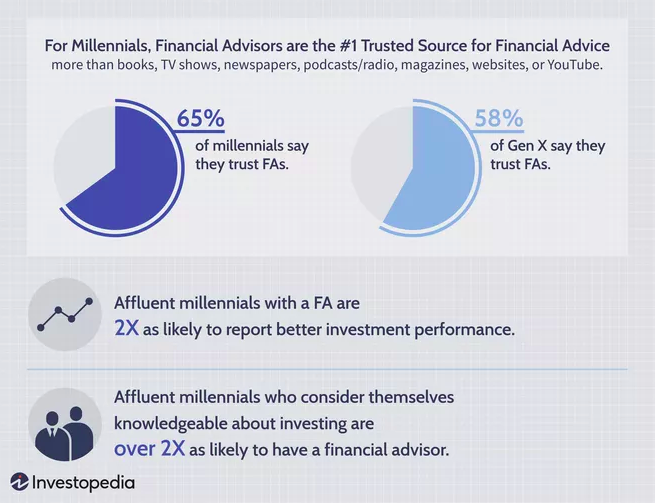

(source: Investopedia)

Listen, I get it – for some people, it’s much easier to just walk into your bank and ask for financial advice. But I hope you’ve learned today that a CFP® at an independent financial planning company can offer a truly unique service and client experience.

Illumint gives me the flexibility to craft the exact services that our target audience (Millennial women) needs. All of our clients have so much in common: they’re in growing families, more than ready to build their wealth.

And I love that I can meet them where they’re at in their financial lives.

The Key Questions For You to Ask Any Millennial Financial Advisor

The first time you talk with a financial advisor, you understandably might feel a little self-conscious. And you may be concerned that you “don’t know what you don’t know.” But I encourage you to ask any minor question that pops into your mind. You have a right to collect all of the information that you need to make a confidence, informed decision.

As a starting point, I wrote a list of the best questions to ask a financial advisor before you make a final decision about how to proceed. You may find these three articles useful, too:

- Questions to Ask a Prospective Financial Adviser (New York Times)

- 5 Critical Questions to Ask a Financial Advisor (CNBC)

- 9 Questions to Ask Financial Advisors Before Hiring One (Huffington Post, featuring me!)

The financial advisors for Millennials that I know pride themselves on being able to answer these questions in a clear, straightforward manner. If you don’t have that experience, I encourage you to move on to the next advisor on your list.

3 Options When You Can’t Afford Financial Planning for Millennials

Ok, so you’re a Millennial and you would really value some practical financial advice. But what should you do if your student loan payments currently prevent you from saving? How should you proceed if, between childcare costs, rent, and other financial priorities, money is just pretty tight right now?

I strongly believe in some form of financial planning for almost everyone. A one-on-one financial planning engagement may not be the best use of your resources right now, though. As alternatives, I suggest the following three options when you can’t afford to hire a financial advisor:

#1: Low-cost financial guidance

Recent technology, including social media, has democratized personal finance in many ways. In addition to fee-only financial advisors, you now have access to financial coaches who understand how to empathize with people in challenging financial circumstances. Their knowledge levels may differ — buyer beware — but they often have succeeded at navigating similar questions that their audience faces. Even if you never purchase a coach’s course or attend their workshop, you may benefit from the content they produce.

#2: Finance podcasts & books

You can easily access dozens of new personal finance blog posts and articles each day. Some are better than others, however. Your best approach for learning more about money probably lies in thoughtful, well-researched books and podcasts. As a starting point, I recently shared my perspective on the five best books for Millennials about money. I’ve also previously published a finance podcast for Millennials, called Financially Well.

#3: Pro bono financial planning

Pro bono financial advice gives financial advisors across the U.S. an opportunity to help those who truly can’t afford to pay for financial planning. The Foundation for Financial Planning (FFP) is a non-profit organization that can connect you with pro bono services from a financial advisor near you. I’ve proudly worked with the FFP’s partners for many years, and I can attest to their important role in our profession — and perhaps in your life, too.

Excitingly, financial planning for Millennials is only just getting started. But you already can start to benefit just by taking the step to engage with one of the financial advisors that I’ve introduced you to today.

Your financial questions may feel just as daunting as you read this, but you’re now so much closer to getting the answers and guidance you need. Keep on going!

Recommended Money Reads for Millennials

If you liked this article, you may also want to check out:

About Kevin Mahoney, CFP®

Hi, I’m Kevin. I’m the founder of Illumint and a financial advisor in Washington, DC. I specialize in financial planning for Millennials like you. As a Millennial father and Certified Financial Planner™, I empower our peers to invest with confidence and flexibility. If you’re new to Illumint, I’m glad you’re here – you now have access to free personal finance tips written specifically for Millennials. I encourage you to read, watch, or listen to the ideas I share about making the most of your money to live the life you want. And then when you’re ready, please send me your thoughts & questions!

Kevin Mahoney, CFP®

About Me

Once each month, 904 Millennials like you receive my free personal finance tips & links

Free Money Tips, delivered monthly.

Address: 641 S Street NW, Washington, DC, 20001 (The Wonder Bread Factory)

© 2025

Illumint is a Registered Investment Advisor in Washington, DC

(Form ADV)